Consumer behaviour in the contact-free economy

‘Prediction is very difficult, especially if it's about the future.’ An apt observation from Nils Bohr, the Danish Nobel laureate in Physics, which is very relevant in these fast moving times as business leaders across the globe seek data to inform short and long term decisions.

In the week where more sections of the UK economy are exiting lockdown, we publish our second article in the series of pivoting to the contact-free economy. Here we present the findings from our proprietary research (a survey of 1,000+ respondents across the UK, conducted in late May 2020) where we begin to uncover approaches that organisations in different business contexts will need to adopt if they want to survive or thrive post-lockdown.

Key take outs:

- The new normal is a lot like the old normal – but more perilous due to real recessionary pressures

- Online sales acceleration is set for continued growth

- Three business archetypes have been identified with very different strategic challenges:

- Sustaining Risers – businesses who have benefited from lockdown who need to hold on to their gains

- Supply Gappers – businesses who will see demand return and face capacity challenges in a contact free world

- Decline Battlers– businesses whowill not see a strong return in demand and need to develop new business models to survive in the long term

The new normal is a lot like the old normal

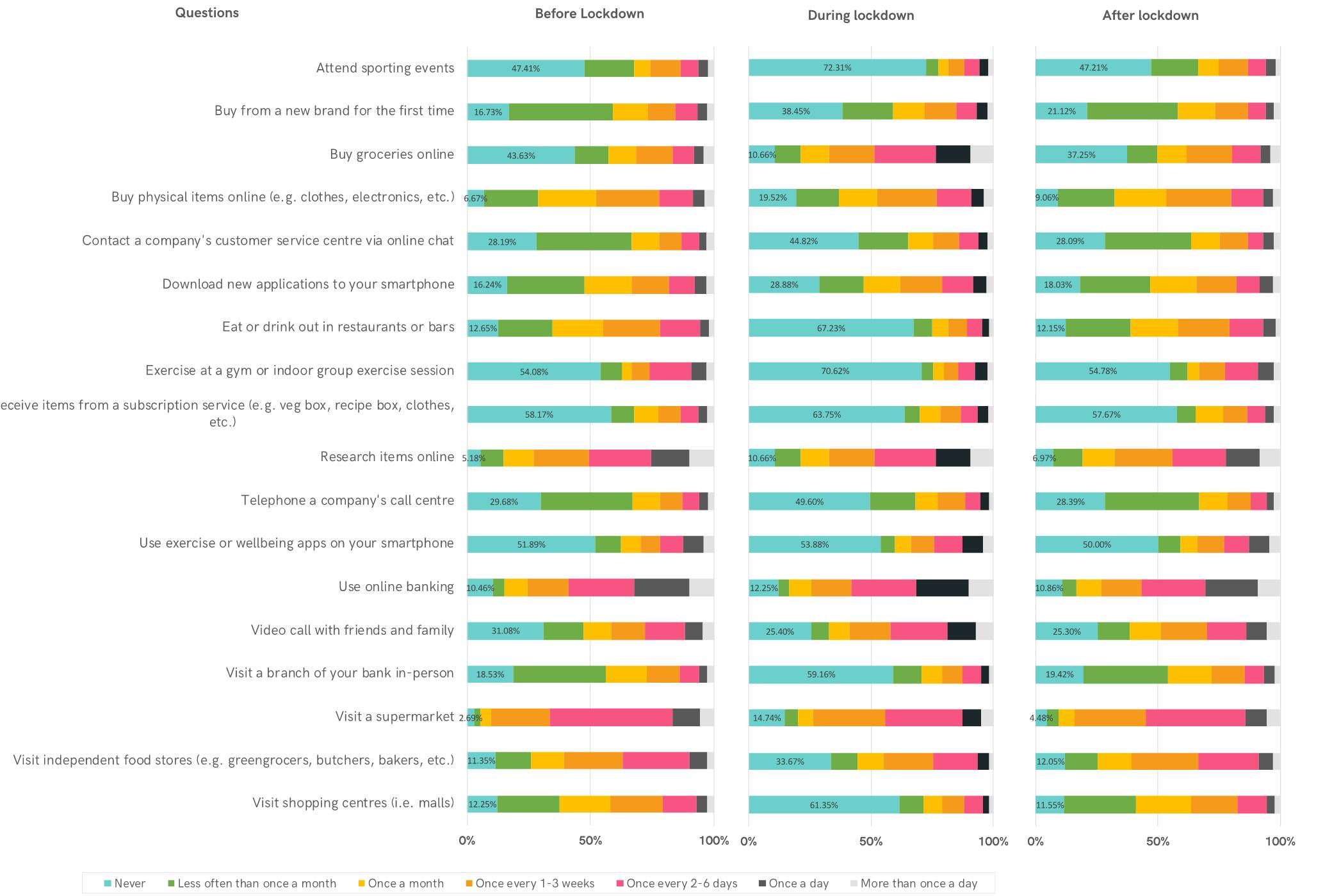

We looked at 18 activities and asked consumers how their behaviours had changed during lockdown, and how they expected them to change once lockdown was relaxed.

While it’s clear that lockdown has affected various aspects of our lives, and will do for some time, in general the British public don’t anticipate radical changes in their habits within many real-world and digital situations. The queues that we have seen outside Primark may be representative of pent up demand and novelty, but the data suggest that the British public do wish to return to previous behaviours.

The data shows large swings during lockdown but a general return to pre-lockdown behaviours once measures are relaxed.

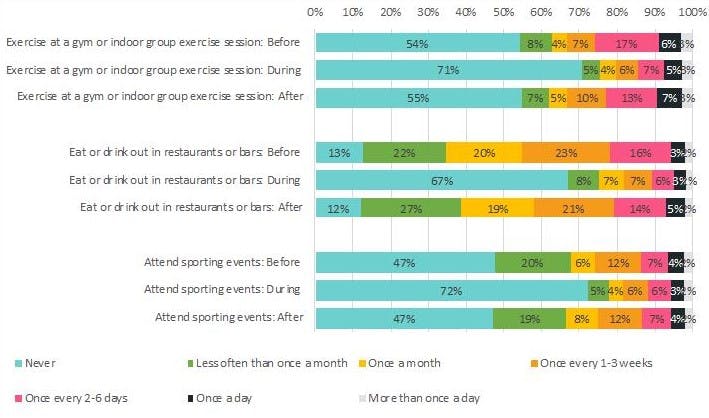

Demand for real-world leisure activities in busy places remains unscathed

Whilst various leisure providers have had to stop operating in the past month or so, our survey indicates British consumers don’t anticipate changing their leisure habits much after lockdown. Specifically, when it comes to attending sports events, going to the gym, or visiting pubs and restaurants – all activities that typically take place in crowded environments – British people by and large expect to do them the same amount as before.

However, while our data suggests demand may not change a great deal (assuming people’s economic prospects don’t change), it’s clear that social-distancing restrictions will affect many organisations’ ability to meet that demand. This trend introduces our second business archetype we’ll examine below – those that need to address the ‘supply gap’.

Online sales acceleration set to continue

A recurring theme within our survey data is the accelerated and continued growth of online shopping - not just groceries but across multiple sectors - at the detriment of high-street activity. This trend introduces our first of three business archetypes – the ‘decline battler’ - which we investigate further below.

Unsurprisingly, a lot of people have taken to buying groceries online during lockdown. What is surprising is quite how many plan to make the shift permanent. According to our survey, 44% of the British public never bought groceries online before lockdown; whereas 37% anticipate never doing so after lockdown. The implication is that 7% of the UK population (aged 16 or older) – i.e. a staggering 3.8 million people - have been introduced to online grocery shopping in the past month or so and intend to keep doing so.

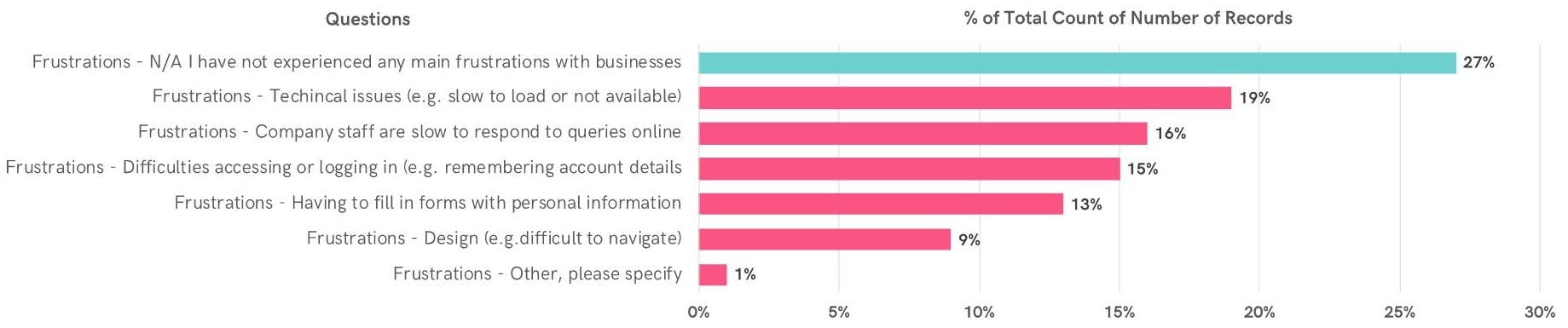

Top frustrations with online services show the importance of getting basics right

Although there is clearly an accelerating trend towards using online services, that experience isn’t necessarily seamless for all users. According to our survey, 73% of British people have experienced some form of frustration when using businesses’ online services during lockdown. The top 3 frustrations relate to accessing the service – whether that be technical issues (e.g. slow to respond or not available) cited by 19% of respondents; company staff being slow to respond to queries (16% of respondents) or difficulties accessing their account/logging in (15%). This data highlights the importance of companies putting the right architecture and resources in place to cope with spikes in activity and ensure they get the basics of customer experience right for all. So, before you embark on trying to revolutionise your customer’s experience with a great AR filter, make sure your website works well, even over a dodgy mobile signal.

The 3 basic business archetypes

While our survey raises some interesting specific insights around the likely changes (or not) in key consumer behaviours that are likely to remain post-lockdown, it also helps us appreciate the broader canvas of the contact-free economy - and how various organisations and sectors will need to respond to those consumer changes.

The high-level trends from our survey data suggests there are 3 basic archetypes, which businesses are likely to fall into:

- Sustaining risers – this group of businesses have benefited from having a good digital offering in place, likely at the heart of their business (e.g. online retailers, well-being apps and social/collaboration apps), and are likely to have seen an influx of new customers. Demand for their service may decline as consumers return to pre-lockdown behaviours and as a result, their strategic focus should be on scaling up their infrastructure and maintaining brand loyalty ahead of the competition. This is likely to manifest through appropriate pricing and offer strategies, propensity modelling and content personalisation, most likely driven by CRM across various digital channels.

- Supply gappers – this group of businesses have been hit hard by COVID-19 (e.g. sports venues, bars, restaurants, gyms, etc.), but demand is likely to return to pre-lockdown levels in the longer term – i.e. consumers haven’t fundamentally changed their preferences towards them. Their priority won’t be maintaining customer loyalty in the same way as the ‘sustaining risers’, rather, working out new approaches to cope with social-distancing that enables them to meet that demand. They’ll need to update the physical experience they offer, of course, and identify areas of frustration that might arise, which they can nullify potentially with digital tools and services. For example, instead of making people queue to access your venue, are you able to schedule and notify customers of specific time slots in advance? How might you smooth out demand from having busy peaks?

- Decline battlers – this group of businesses (generally high street retailers with limited online offerings) are in a trickier spot than the two above. Demand has been hit in the short term and despite a post-lockdown bounce is likely to continue declining in the longer term at their brick-and-mortar sites. Where appropriate, these businesses need to quickly spin-up a robust online offering for their customers and overcome the internal operational challenges that may present around logistics management – no mean feat. Alongside that online offering they need to understand the natural advantages they possess against purely online retailers who can’t offer an in-store experience and look to amplify those advantages for their customers – whether that be the convenience of ‘click-and-collect’ or in-store returns or providing richer, in-store experiences with excellent inter-personal customer service from shop assistants. Again, it’s likely that service can be enhanced with digital tools in the hands of those shop assistants.

It should be noted the archetypes above are just that - archetypes - and in reality each individual business will have its own specific situation, challenges, customer base and competition to consider. High level strategy you devise to succeed in the contact-free economy and the more detailed roll-out of that plan, including development of digital tools, should be tailored to your organisation’s needs. Hopefully the above framework provides one aid to developing that strategy through useful discussion.

If you’d like to talk to us about any of the findings from our survey or about how we might be able to support your strategic development and roll-out, ready for the contact-free economy, simply get in touch.